BNB breaks $800 as UK rethinks digital pound

Also: Telegram launches its crypto wallet for U.S. users, South Korea restricts ETF exposure, and Bless begins trial of its decentralized compute network

Today's headlines

– BNB hits $801, first altcoin ATH this cycle

– Individuals still hold most BTC but only just

– Jack Dorsey’s Block rolls out Bitcoin payments

– DOJ seizes crypto in $97M oil scam

– Bank of England hits pause on CBDC

– UK targets ransomware payouts

– PNC Bank expands Coinbase partnership

– Kraken’s Jesse Powell cleared by FBI

– 21Shares files for spot ONDO ETF

– South Korea limits ETF crypto stock exposure

The Crypto Radio LIVE has just launched across platforms, bringing you the hottest topics of the day wherever you are. Tune in weekdays at 1pm GST – Dubai time – for daily news in a brand new format.

Below is a breakdown of everything we covered today – Wednesday July 23, 2025 – from UK to US and ETFs to shared computers. Make sure you tune in again tomorrow on YouTube and X to catch the news as it happens.

BNB sets the tone with first ATH of the cycle

BNB has officially become the first major altcoin this cycle to break its previous all-time high, reaching $801 in early trading before slipping back slightly. It’s a significant milestone that many see as a sign altseason may finally be kicking off. Binance Smart Chain activity has been climbing, fueled by renewed DeFi interest, NFT volumes, and memecoin experimentation across the network. CZ thanked the community in a celebratory post, adding that the growth reflects years of “building through the bear.”

Build and Build. $BNB

– CZ 🔶 BNB (@cz_binance) July 23, 2025

Appreciations to all the ecosystem players, BTC maxis, ETH holders, meme traders, ETF applicants, treasury pub cos, good regulators, and utility builders. 🙏 pic.twitter.com/5YreSKU7xQ

At a macro level, the crypto market cap is holding steady above $4 trillion. Bitcoin remains just above $118,000, and Ethereum is trading in the $3,600–$3,700 range. The Fear & Greed Index sits at 74, which puts us firmly in “greed” territory. That’s often when market momentum peaks – but it can also signal short-term corrections ahead.

Individuals still hold most BTC – but only just

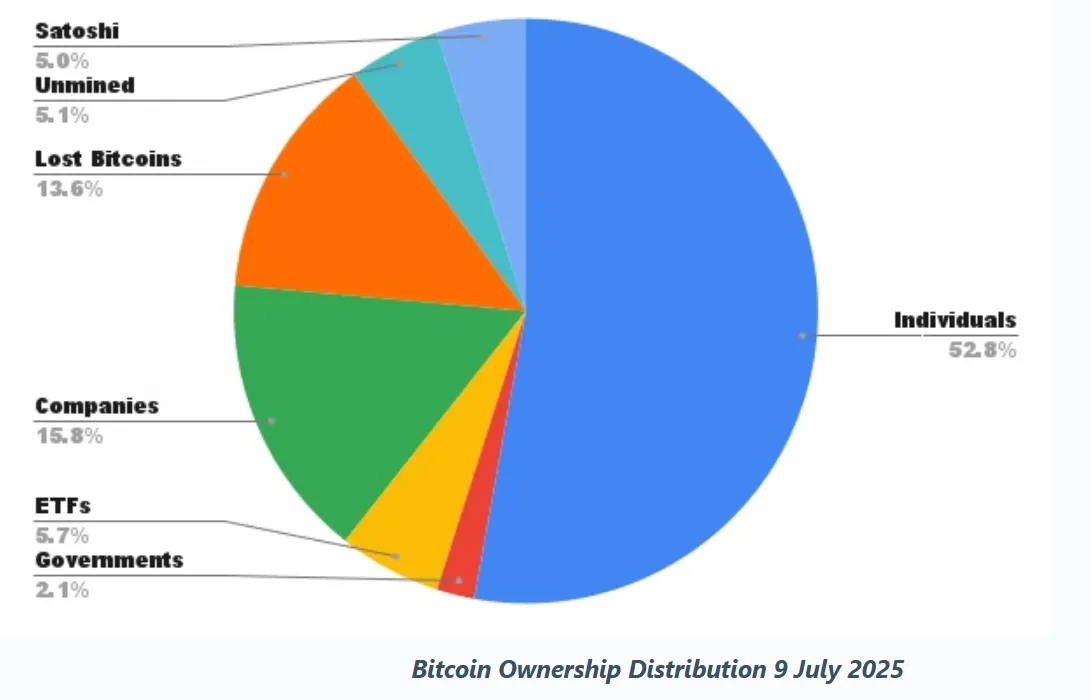

Individuals still hold just over half of all Bitcoin, but institutions, funds, and governments are closing in. Photo: A2Z Cryptocurrencies

Fresh July data shows that individual ownership of Bitcoin has dropped to around 51% of total supply – its lowest level yet. While individuals still hold the majority, the shift has sparked renewed concern over Bitcoin’s decentralization and future accessibility.

Institutions and corporations now control a growing share. Financial institutions collectively hold 4.73 million BTC, or 21.5%, with Strategy (formerly MicroStrategy) leading at 597,325 BTC. ETFs and funds collectively hold another 1.26 million BTC (5.7%), led by BlackRock’s IBIT with over 700,000 BTC. Governments own roughly 461,200 BTC – about 2.1% of the total supply – with the U.S. and China each holding nearly 200,000. Meanwhile, Satoshi Nakamoto is still believed to hold about 1.1 million BTC, or 5%.

With only 1.12 million Bitcoin left to be mined and around 14.3% already lost or locked forever, that leaves less than 20% of the total supply truly up for grabs. As ETF inflows rise and corporate wallets grow fatter, the numbers paint a clear picture: Bitcoin is getting harder to access, and increasingly concentrated.

World’s first shareable computer enters testnet

Bless Network has opened up access to the testnet for what it calls the world’s first “shared computer” – a global, decentralized network powered by everyday devices instead of data centers. By installing a Chrome extension, users can contribute idle compute power from laptops, desktops, and phones to support decentralized applications. In return, they accrue uptime minutes and can earn rewards as the network grows.

Rather than relying on Amazon or Google to run the internet, Bless wants users to power the services they use themselves. Its system dynamically allocates tasks based on each device’s capabilities, using WebAssembly for security and fallback routing to ensure reliability. The goal is to reduce reliance on institutional cloud providers while enabling developers to build dApps that scale as their user base grows – powered directly by the users.

Dorsey launches Bitcoin checkout tool

Jack Dorsey’s Block rolls out Bitcoin payments for US merchants via Square, aiming to bring BTC into everyday retail

Jack Dorsey’s payments company Block is making Bitcoin usable at the register. A new Square feature now lets small businesses across the U.S. accept BTC via Lightning, using the same terminals they already have. Customers can pay in Bitcoin and merchants can either hold it or instantly convert to USD.

The update comes as Block joins the S&P 500, and weeks after it launched new Bitcoin-focused products including BitChat and the Sunday App. With more than $1 billion in BTC on its books, Block continues to push for Bitcoin as everyday money – not just digital gold. Dorsey has long said Bitcoin is “the currency of the internet,” and this move puts that vision in the hands of actual business owners.

DOJ seizes crypto from fake oil & gas scheme

The U.S. Department of Justice has confiscated over $7 million in cryptocurrency linked to a fraudulent oil and gas investment scheme that ran for years and stole a total of $97 million. The operation promised massive returns through fake energy projects and was primarily aimed at retirees. Some victims didn’t even know crypto was involved until the DOJ began tracing funds.

Authorities say the fraudsters funneled investor money into personal spending and crypto wallets, disguising the movement of funds across multiple chains. The recovery was made possible through blockchain forensics and cooperation between agencies. The DOJ has begun the process of returning funds to verified victims.

FBI clears Kraken founder Jesse Powell

Kraken founder Jesse Powell is in the clear. The FBI has officially concluded its investigation, returned his seized devices, and closed the case. Powell, who had remained relatively quiet during the inquiry, posted that he’s “very glad to have this behind me” and that the situation “never made sense.”

Very glad to have this behind me. It never made sense but neither does the @rstormsf trial. Wild how quickly you can have your life upended. I'm grateful for those who saw through it and for my stellar legal team. Now, turning my attention back to @krakenfx. 🐙🚀 https://t.co/LbaDxN0bCl

– Jesse Powell (@jespow) July 22, 2025

Throughout the process, Kraken’s platform and user funds remained unaffected. Powell, a longstanding advocate for privacy and free speech in crypto, is now resuming leadership at Kraken just as the exchange expands its global operations.

South Korea limits ETF exposure to crypto stocks

South Korea limits ETF exposure to crypto stocks like Coinbase, reviving earlier rules amid renewed caution. Photo: Unsplash / Daniel Bernard

South Korea’s financial regulator has told domestic asset managers to cap their exposure to crypto-linked stocks like Coinbase within ETFs. The guidance revives rules from 2017 and reflects ongoing caution about indirect crypto risks.

The timing is notable, as South Korea has recently shown signs of warming to crypto, including clearer tax policy and support for retail access. But officials say the new restriction is aimed at ensuring stability and compliance as local ETFs grow in popularity.

Bank of England hits pause on CBDC

The Bank of England is cooling on the idea of a central bank digital currency (CBDC). Once seen as “likely needed,” the project is now under review after Governor Andrew Bailey told UK lawmakers he’d need “a lot of convincing” to proceed. The shift comes as commercial banks improve digital payment infrastructure, possibly removing the need for a state-issued digital pound.

The Atlantic Council’s global CBDC tracker shows nearly 50 countries currently piloting similar projects, but momentum is stalling in some regions due to privacy concerns, technical hurdles, and growing political resistance. In the U.S., Congress has passed a bill requiring approval for any future CBDC rollout.

UK targets ransomware payouts

A new proposal in the UK would ban public services and critical infrastructure providers – including the NHS, councils, and energy companies – from paying ransomware demands. The draft policy would also require any victim to report an incident within 72 hours and submit a full report within 28 days.

The move expands an existing rule that prevents central government departments from paying ransoms and reflects rising concern about the financial and operational impact of cyberattacks. While most responses in the public consultation backed the plan, some questioned whether victims who violate the policy could face legal penalties.

PNC Bank extends Coinbase partnership

PNC, one of the largest U.S. banks, is deepening its relationship with Coinbase to roll out new crypto services for institutional clients. While details haven’t been made public, the partnership signals continued movement from traditional finance into crypto – especially at a time when regulatory clarity is improving for some large players.

This comes as part of a broader trend of TradFi institutions, including BlackRock and Fidelity, integrating crypto into their client offerings. Analysts say the Coinbase–PNC relationship could pave the way for more robust, compliant exposure to digital assets at the bank level.

Customers of one of the largest banks in the US wanted easier access to crypto.

– Coinbase 🛡️ (@coinbase) July 22, 2025

So we've partnered with them to make it happen. @PNCBank clients will soon be able to buy, sell and hold crypto. pic.twitter.com/m801TSXevn

21Shares targets DeFi with ONDO ETF

Crypto ETF specialist 21Shares has filed a preliminary application for a spot ONDO ETF with the U.S. SEC. The fund would hold ONDO, the native token of Ondo Finance, a platform focused on tokenized real-world assets.

The goal is to give traditional investors exposure to DeFi protocols without the need for self-custody wallets or direct on-chain interaction. The move follows a wave of interest in tokenized bonds and private credit markets, which some see as the next frontier for crypto–TradFi integration.