Binance launches halal staking to bridge DeFi gap

'Muslim communities make up nearly a quarter of the world’s population,' Binance CEO says at Sharia Earn launch

Binance has introduced what it calls the first Sharia-compliant crypto staking platform — a move aiming to address a long-standing tension between decentralized finance and religious compliance.

For years, millions of Muslim investors have been intrigued by the promise of crypto but held back by uncertainty: are digital assets halal or haram? Can staking rewards be earned in ways that align with Islamic principles? With Sharia Earn, Binance steps into this sensitive and often-overlooked space, where financial innovation meets religious ethics.

The product’s launch comes amid surging crypto adoption across Muslim-majority countries, where blockchain tools are seen both as economic opportunity and as a challenge to navigate within the frameworks of Islamic finance.

What is Sharia Earn?

Binance has launched the world’s first certified Sharia-compliant multi-token staking product, called Sharia Earn, which lets users stake BNB, ETH, and SOL to earn halal rewards.

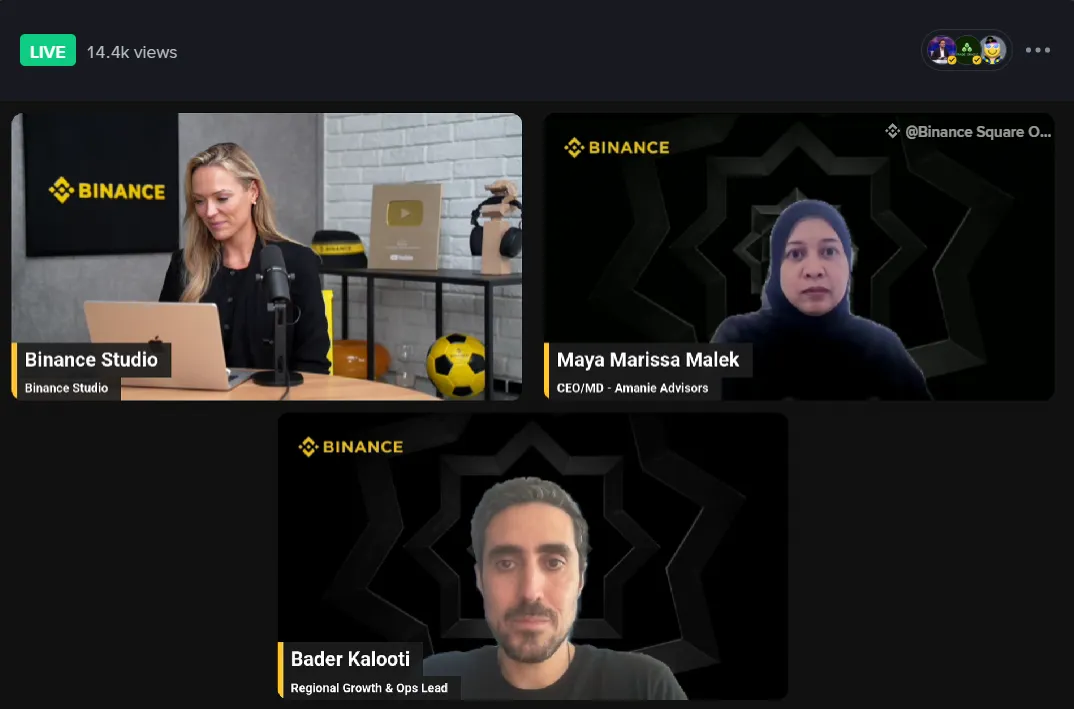

The announcement was made during a Binance Square webinar titled Sharia Virtual Super Meetup: Our Move into Islamic Finance, where company leaders and advisors explained the significance of merging crypto staking with Sharia guidelines.

Certified by Amanie Advisors, a global Islamic finance consultancy, Sharia Earn operates under a Wakala agreement — an investment agency contract under Islamic law — ensuring no prohibited activities. The platform builds on Binance Earn’s existing BNB Lock Products and ETH and SOL staking, with mechanics reviewed by Sharia scholars.

The product is initially available in 31 countries across the Middle East, North Africa, and Asia, with plans for further global rollout.

Why inclusivity matters

For many Muslims, religious considerations have made it difficult to participate fully in the decentralized finance (DeFi) boom. Binance says Sharia Earn aims to offer a simple way for Muslims to engage in staking without compromising their beliefs.

“Muslim communities make up nearly a quarter of the world’s population, and they represent some of the strongest economies, brightest minds, and boldest innovators on the planet,” Binance CEO Richard Teng said during the webinar.

“Many live in regions where cryptocurrency offers real, practical solutions for everyday challenges. It was designed to create financial excitement and a truly inclusive financial system that respects the values and needs of every community, and that’s the vision behind this launch,” he added.

Bader Kalooti, Binance’s Regional Growth and Operations Lead, pointed to growing demand: “Crypto adoption has increased drastically across many Muslim-majority markets, but until now, certain yield-generating products have remained out of reach. We built Sharia Earn to change that.”

Kalooti also noted, “Binance has over 25 million users, but only around 3% are moving their products. That’s a huge gap we plan to address.”

The future of halal DeFi

Industry observers say Sharia Earn could mark the beginning of a larger trend. Abdul Rafay Gadit, founder of ZIGChain, called the initiative “a great opportunity to bring financial products to people who care about Islamic finance ethics.”

“Even non-Muslims see the essence of Sharia compliance in a deeper way, because the nature of capital there is less extractive,” Gadit added.

Maya Malek, CEO of Amanie Advisors, explained that halal-compliant tokens must meet specific criteria, including avoiding usury, excessive uncertainty, and prohibited sectors such as alcohol. Tokens like Bitcoin, Ethereum, Solana, and Binance Coin are generally seen as compliant because they are utility assets.

Gadit pointed to a growing category of halal investment infrastructure, including tokenized yields, fund structures, and Sharia-compliant stock indices. He predicted other exchanges might follow Binance’s lead, developing halal-based products such as tokenized U.S. stocks and other instruments.

“The key will be education and building trust with a potential 2-billion population market,” Gadit said.