Can you make money with crypto arbitrage?

Traders exploit exchange price gaps for profit. Here’s how it works – and what to watch for

Ever noticed how the same item can cost more at one store than another?

In the world of crypto, these price gaps can become opportunities to make money through arbitrage trading – a strategy where traders aim to profit from pricing inefficiencies between platforms.

How crypto arbitrage trading works

Crypto arbitrage involves taking advantage of price differences for the same cryptocurrency across different exchanges. Traders buy a crypto asset at a lower price on one platform and sell it for a higher price on another.

These arbitrage opportunities in crypto arise from the global and decentralized nature of the market, along with factors like exchange fees, trading volumes, and liquidity levels.

To see how prices differ in real time, you can check a crypto price comparison tool like CoinMarketCap, which shows prices across multiple exchanges.

While these price gaps offer potential gains, executing a successful trade isn’t always easy. The market moves fast, and real-time crypto arbitrage depends on spotting and acting on opportunities before they disappear.

Transaction fees and network delays can reduce profits. The competition is intense, and precise timing is critical – making it one of the more advanced crypto trading strategies to master.

Unlike traditional markets, the crypto market never sleeps. Its 24/7 pace increases the number of potential trades – but also the risks. Successful arbitrage traders often use specialized tools or even arbitrage bots in cryptocurrency trading to monitor platforms and execute trades automatically.

Tools like 3Commas are commonly used to automate trading strategies and manage risk more effectively.

Types of crypto arbitrage strategies

Cross-exchange arbitrage

This is the most straightforward form of arbitrage. Traders purchase a cryptocurrency at a lower price on one exchange and sell it for a higher price on another.

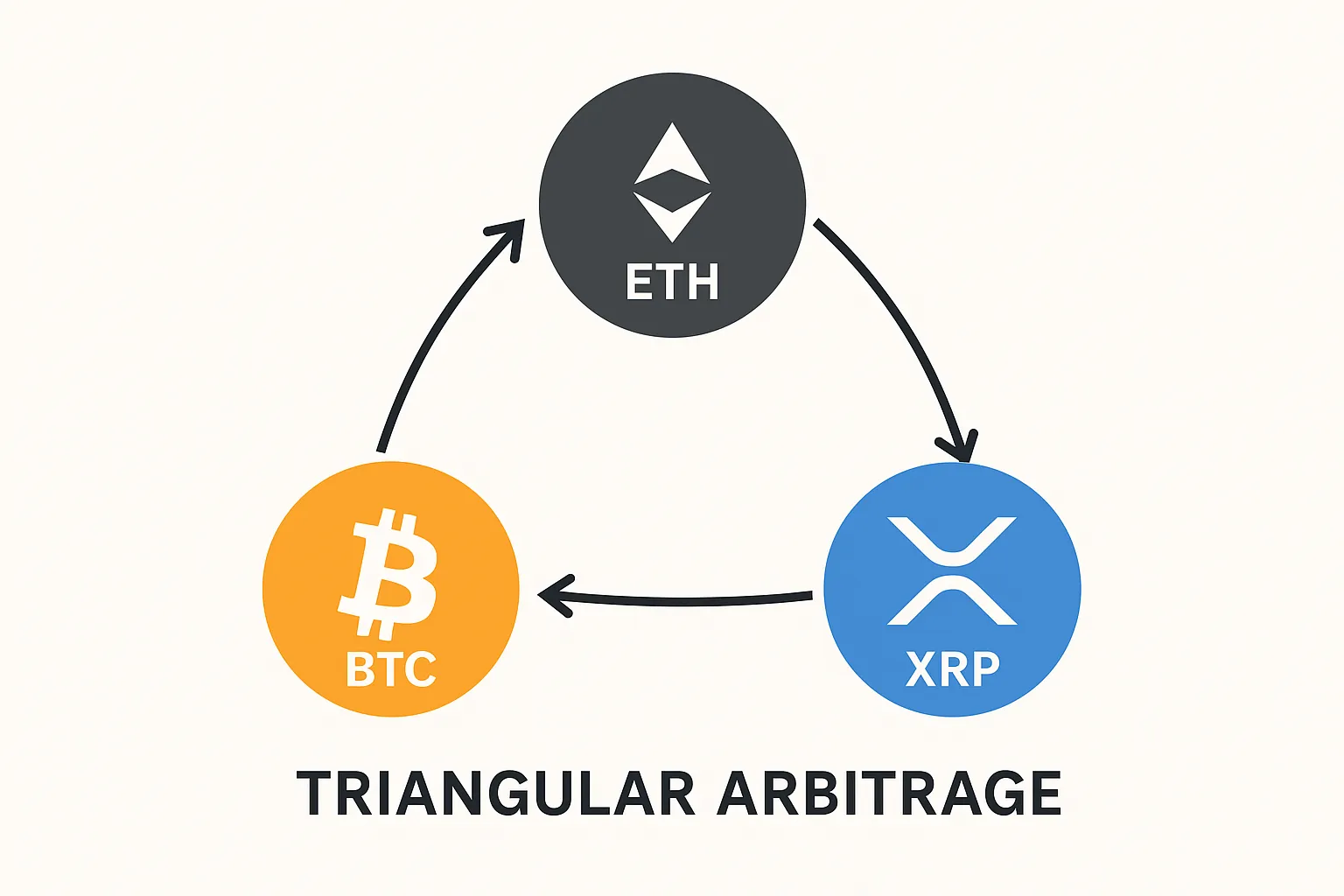

Triangular arbitrage

Triangular arbitrage takes advantage of price differences between three trading pairs. For example, a trader might exchange BTC for ETH, then ETH for XRP, and finally XRP back to BTC – making a profit from the pricing inefficiencies across the steps.

Spatial arbitrage

Spatial arbitrage uses location-based differences. Traders exploit price gaps between exchanges based in different countries – such as buying Bitcoin on a Canadian exchange and selling it on a US platform. However, this strategy can be complicated by varying regulations across jurisdictions.

Can you make money with crypto arbitrage?

Crypto arbitrage presents real possibilities to profit from crypto market inefficiencies, especially for those who understand how to profit from crypto volatility. With the right tools, research, and strategy, traders can capitalize on short-term price differences.

However, success depends on more than just spotting a gap. Quick decision-making, trustworthy platforms, and an understanding of market dynamics are all essential. For those who can manage the risks, arbitrage can be one of the most dynamic ways to trade in crypto.

Do you need bots for crypto arbitrage?

Not always – but they help. Some traders execute arbitrage manually, especially for simple trades between two exchanges. But since price differences can disappear in seconds, many rely on crypto arbitrage bots to monitor prices and place trades automatically.

A site like CoinArbitrageBot can help users track current opportunities across multiple platforms. While bots can boost speed and efficiency, they require setup, strategy, and some technical knowledge.