Mapped: The world’s biggest crypto markets in 2025

Trading volumes set to exceed $297 trillion in 2025 – these are the countries and regions driving the surge

Crypto trading is surging worldwide, with volumes projected to exceed $297 trillion in 2025 – a 180% increase in just four years. But which countries are driving this boom?

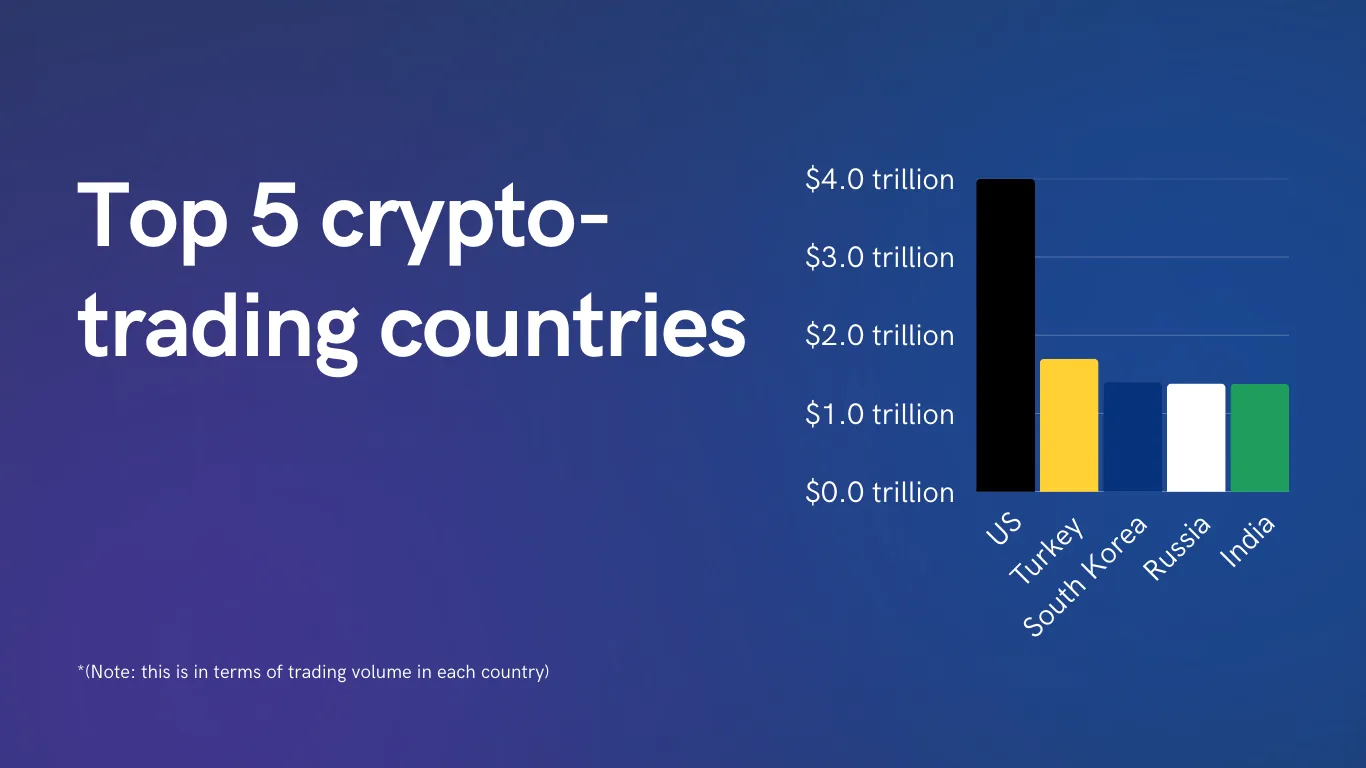

A new study by CryptoNinjas and Storible breaks down the biggest crypto markets, revealing some surprising leaders. While established financial hubs continue to dominate, fast-growing economies and regions facing economic instability are turning to crypto at unprecedented rates.

Analyzing data from centralized (CEX) and decentralized (DEX) exchanges, the study highlights how different regions are shaping the market. One country leads the world with over $1 trillion in trading volume, while another is seeing its crypto market grow fivefold in just two years.

So, where is all this trading happening? Let’s dive into the numbers.

1. Europe (49.27% of global volume)

Europe leads global crypto trading, driven by strong liquidity, institutional participation, and high-volume markets like Russia. MiCA, set to take full effect in 2024, has yet to influence trading volumes, though its compliance requirements could pose challenges for smaller firms. While financial hubs like London and Frankfurt contribute, Russia plays a major role, accounting for $1.38 trillion in trading volume.

Russia

As the fourth-largest crypto-trading country, Russia’s market is fueled by global transfers and alternative investments, particularly amid regulatory uncertainty. The central bank allows companies to use cryptocurrencies for cross-border transactions.

Mati Greenspan, CEO of Quantum Economics, told CNBC, “Previously, Russia would not want to allow that kind of transactional freedom to its citizens – but now we’re at the point that bitcoin is used so often in everyday commerce that the opportunity cost for them not to allow it is simply too great.”

2. Asia (27.11%)

Asia ranks second, driven by inflation concerns, currency devaluation, and a tech-savvy population. Turkey and Pakistan see high crypto use as a hedge against economic instability, while South Korea and Vietnam’s thriving crypto gaming and DeFi sectors push up trading volumes.

Turkey

Turkey’s trading volume reached $1.7 trillion, making it the second-highest crypto-trading country. With inflation averaging over 40% in the past five years, many Turkish citizens have turned to cryptocurrency for financial refuge.

Stablecoin use in Turkey is also driving this growth. According to Chainalysis, stablecoins were responsible for 4.3% of the country’s GDP from April 2023 to March 2024.

South Korea

South Korea reached a trading volume of $1.4 trillion, making it place third among the top countries. This is no surprise. Crypto has become deeply ingrained in South Korea’s retail financial landscape, with over 30% of South Koreans reportedly investing in cryptocurrency, according to Yonhap News. The rise in South Korean crypto users was attributed to the US elections.

The country’s crypto users were also estimated to hold KRW 102.6 trillion (US $70.3 billion), reflecting strong retail participation. The remarkable transaction volume in the country is even posing threats to its stock market.

India

Despite India’s turbulent relationship with cryptocurrencies, it is still part of the top five crypto-trading countries, amassing a $1.381 trillion trading volume. Young Indians are exploring the world of crypto to supplement their income. According to Kush Wadhwa, a partner at the Grant Thornton Bharat consulting firm, the country’s crypto market could exceed $15 billion by 2035, with a yearly growth rate of 18.5%.

3. North America (8.95%)

North America ranks third in global crypto trading, largely due to the United States, which remains the world’s largest crypto-trading country. In 2025, U.S. trading volume is projected to reach $4.46 trillion, with Canada following at over $662 billion.

United States

Despite leading in total volume, U.S. citizens trade relatively modest amounts individually, with an average monthly crypto spending of $958 per person. The country’s market strength comes from institutional adoption, regulatory developments, and expanding financial infrastructure. The launch of crypto exchange-traded funds (ETFs) and participation from financial giants like BlackRock have further fueled activity. Meanwhile, new policy shifts, including President Donald Trump’s approval of the Strategic Bitcoin Reserve, continue to shape the landscape.

4. Africa (7.30%)

Africa is the fastest-growing crypto market, with trading volumes expected to be five times higher in 2024 than in 2022. Nigeria leads the continent, surpassing $330 billion in trading volume this year. Crypto adoption is driven by limited banking access and economic instability, with Nigerians allocating over 63% of their monthly income to digital assets – one of the highest rates globally.

5. South America (4.19%)

Crypto adoption in South America is fueled by hyperinflation and economic instability. In Argentina and Venezuela, citizens turn to Bitcoin and stablecoins to escape currency devaluation and capital controls. Brazil, on the other hand, has seen higher institutional participation due to a stronger regulatory framework. Meanwhile, Chile and Peru are experiencing growing adoption, driven by increased fintech integration and everyday crypto transactions.

Crypto’s global momentum

Crypto trading is booming worldwide, with Europe leading in volume and the US as the top trading country. Other regions and countries are also shaping the industry in different ways. As activity grows, these trends will continue redefining the global crypto landscape.