The cryptocurrency era: Are we on the brink of a financial revolution?

From Trump’s $TRUMP coin to Davos debates, experts assess crypto’s potential to redefine global finance

The rise of cryptocurrency has been a hot topic for years, but recent developments suggest that we might be at the cusp of a true digital finance revolution. At the 2025 World Economic Forum Annual Meeting in Davos, experts gathered to discuss whether the global financial system is ready for this transformation. With Donald Trump’s pro-crypto presidency setting the stage for regulatory overhaul, the future of cryptocurrency is poised to shape not just the US, but the entire world.

The trump effect: A catalyst for change

Currencies have historically been tied to nations, their value often symbolized by the faces of leaders. Yet, in an unprecedented move, Donald Trump launched the $TRUMP cryptocurrency just days before taking office. This bold step reflects his ambition to position the U.S. as the global leader in crypto innovation. According to Brian Armstrong, CEO of Coinbase, this marks a pivotal moment for the industry. “To have the leader of the largest GDP country in the world come out undeniably and say that he wants to be the first crypto president… this is unprecedented,” Armstrong stated.

Trump’s administration has made it clear that crypto regulation is a priority, with Republicans aiming to pass legislation by early 2026. As Anthony Scaramucci, founder of SkyBridge Capital, noted, the urgency stems not just from economic goals but also political strategy, as Republicans aim to campaign on their crypto stance.

Regulation: A double-edged sword

While clear and comprehensive regulation could unlock the potential of cryptocurrency, it presents significant challenges. As Lesetja Kganyago, governor of the South African Reserve Bank, explained, regulators are grappling with the complexity of crypto. “In many instances, regulators are struggling to come to grips with exactly what they are having to regulate,” he said.

Jennifer Johnson, CEO of Franklin Templeton, emphasized that existing financial regulations were born out of crises like the Great Depression. Similarly, crypto laws must evolve to address modern technological advancements. “The technology is advancing so quickly that [regulators] have to evolve regulation to meet it,” Johnson argued. However, the speed and global nature of crypto transactions complicate this process, leaving many policymakers overwhelmed.

Jennifer Johnson (@FTI_Global) highlights the extraordinary growth of the crypto space. #wef25 pic.twitter.com/jeAB2arMdI

— World Economic Forum (@wef) January 21, 2025

The overlooked utility of blockchain

Despite its negative reputation in some circles, blockchain—the technology underlying cryptocurrency—offers undeniable benefits. Denelle Dixon, CEO of the Stellar Development Foundation, highlighted its transformative potential. “You can move assets extremely quickly, peer-to-peer, and get them, without borders, all over the world,” she explained. For instance, the United Nations High Commissioner for Refugees (UNHCR) has used blockchain to deliver aid to Ukraine in under three minutes—a stark contrast to traditional financial systems.

Dixon argued that regulation could create opportunities to showcase these real-world applications and integrate crypto with traditional financial services. By addressing misconceptions and focusing on utility, she believes the industry can shift the narrative around digital finance.

A new financial frontier

The adoption of cryptocurrency isn’t just about innovation; it’s about updating the financial system to be faster, cheaper, and more efficient. Armstrong predicted that US legislation could set a global precedent, with other G20 nations following suit. Meanwhile, Kganyago revealed that the South African Reserve Bank has already piloted blockchain technology to reduce transaction settlement times from a day to just 46 minutes.

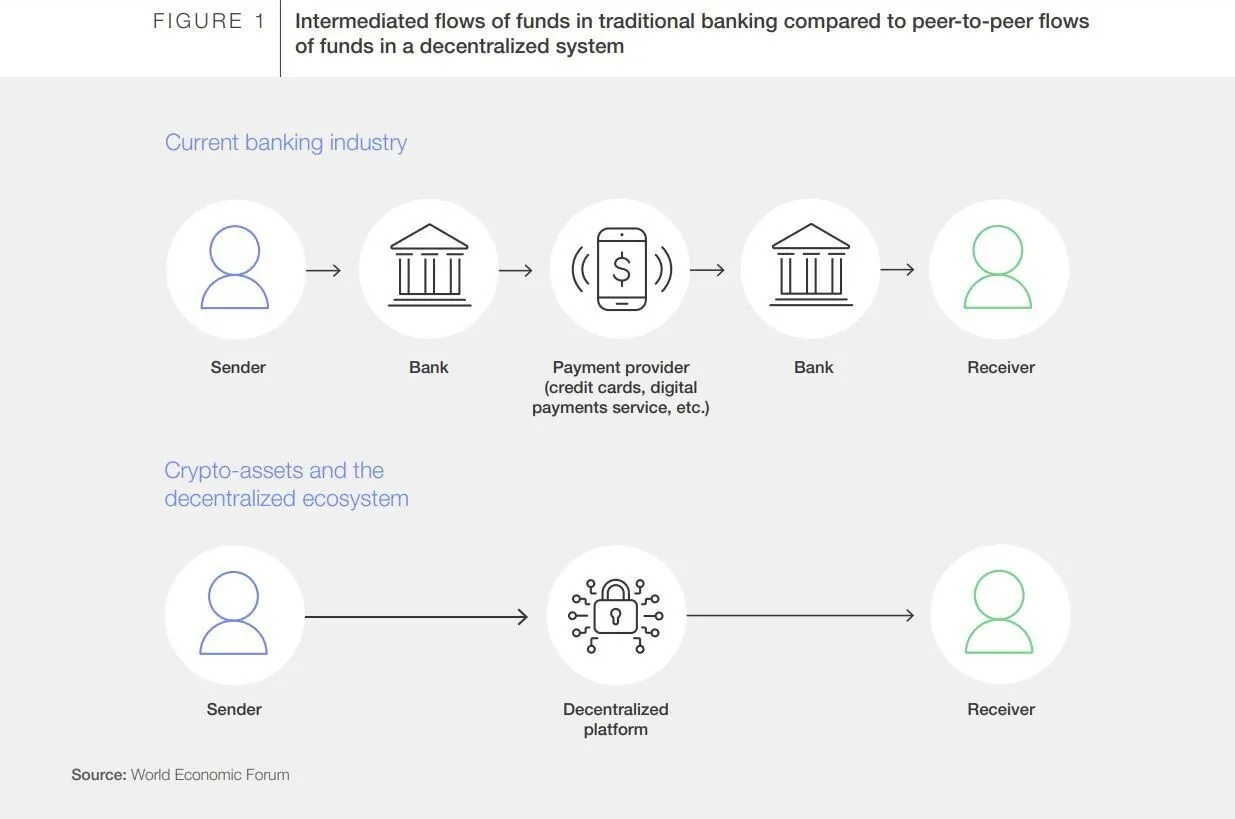

The implications for consumers are profound. From enabling instant payments to earning interest on deposits in mere minutes, blockchain technology has the potential to redefine how we think about money. Johnson pointed out the power of “atomic settlements,” where transactions are executed instantaneously, eliminating the need for traditional banks as intermediaries. However, this disruption could significantly impact existing financial business models.

Challenges ahead

Despite the promise of digital finance, integrating crypto into traditional systems remains a challenge. Johnson likened the current state of the industry to “two parallel universes running together.” While the crypto space continues to grow, traditional finance has yet to fully acknowledge its potential.

Scaramucci highlighted the generational gap in understanding, noting that many older policymakers struggle to grasp the industry’s nuances. Overcoming these barriers will be critical to achieving regulatory clarity and fostering innovation.

The road ahead

As the US moves toward clearer crypto regulations, the global financial landscape is on the brink of transformation. The $TRUMP cryptocurrency and Trump’s pro-crypto stance could be the catalyst that ushers in a new era of digital finance. However, the road ahead is fraught with challenges—from regulatory hurdles to public misconceptions.

The conversations at Davos underscored that cryptocurrency is no longer a niche interest; it’s a technology with the potential to reshape the global financial system. Whether this era begins in 2025 depends not just on legislation but on the industry’s ability to demonstrate its value to the world. As Johnson aptly put it, “At some point, these parallel universes have to come together.”

The question now is not whether cryptocurrency will shape the future, but how—and who will lead the way.