The man building crypto your grandma could use

Mo Asadian wants to make web3 so simple even non-techies can invest in real estate

Part one:

Part two:

When Mo Asadian talks about the future of finance, he doesn’t mention algorithms or hype coins. He talks about his grandmother.

The founder of IOPn, which stands for Internet of People, is working toward a future where anyone – regardless of age or tech skills – can invest in real estate or other assets straight from their phone, no paperwork or middlemen required.

In a candid conversation with The Crypto Radio, Asadian shared his journey from Swiss banking to blockchain. A certified investment manager who once worked with top-tier financial institutions, he wasn’t always a crypto believer. That changed after watching a TED Talk about distributed ledger technology – his self-described “aha moment.”

“Before taking steps, regulators look at things from different angles,” Asadian explained, highlighting the complex landscape of technological innovation. His career trajectory mirrors a broader trend of financial professionals recognizing blockchain's transformative potential.

Fixing what’s broken in web3

The core mission of IOPn is deceptively simple: make web3 technology user-friendly.

“Web3 isn’t ready for mass adoption,” Asadian said. “Our UI sucks. It’s not really user-friendly. You’ve got to be tech-savvy to use web3 wallets.”

Web3 represents a new internet era where users have more control over their digital experiences – unlike the current model dominated by large tech companies. But right now, it’s complicated. So complicated that most people find it intimidating.

Asadian’s solution? Create interfaces so intuitive that “any average Joe, my grandmother” could use them. This user-first mindset sets IOPn apart in the rapidly evolving blockchain space.

Why tokenizing real estate could change everything

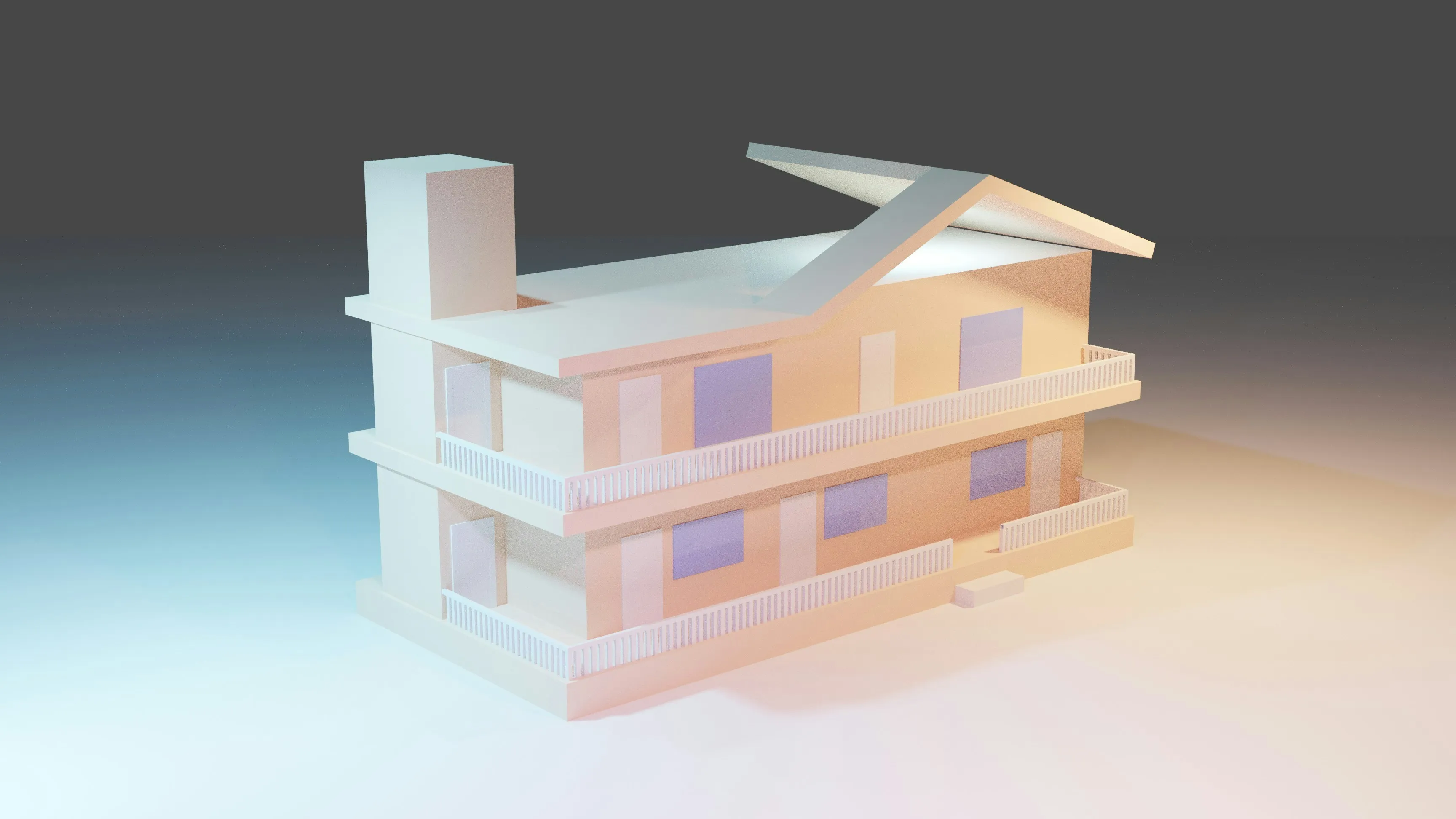

Tokenization could turn real estate into digital assets, making it easier to buy, sell, and invest. Photo: Unsplash / Ashin K Suresh

A key focus for Asadian is real-world asset (RWA) tokenization – essentially converting traditional assets like real estate or stocks into digital tokens that can be easily traded.

To put this into perspective, the global real estate market is worth over $400 trillion, but it's notoriously illiquid.

“If you have an apartment in Dubai and decide to sell, it would take a month or two in the best case scenario,” he explained.

Tokenization could change all that. Imagine owning a fraction of a high-value property or trading real estate as easily as buying a stock online. This isn't just theory – major financial leaders like BlackRock’s Larry Fink say tokenization could be the next big trend in securities.

Regulators are catching up – slowly

Regulatory challenges have long been a sticking point. Asadian recalled trying to launch a tokenization project in 2018, only to be blocked by unclear legal frameworks.

“Regulators tend to be lagging behind innovators,” he said. “Usually regulators are probably 5-6-7 years behind, and it takes time.”

That patience is starting to pay off. Asadian's strategic partnership with Ras Al Khaimah (RAK) in the United Arab Emirates represents a $100 million investment in web3 innovation. Once a relatively unknown emirate, RAK is now positioning itself as a hub for digital assets, welcoming global talent to build next-generation tech.

Designing web3 for real people

For Asadian, this isn’t just about building better tech. It’s about inclusion. He believes tokenization can bridge generational gaps in financial understanding.

“If you exclude Gen Z, millennials and Baby Boomers are skeptical of crypto and digital assets. They would rather have tangible assets,” he said.

By making digital investments easier and more relatable, Asadian hopes to onboard the “next billion users” to web3. His approach combines technical innovation with an understanding of psychology – recognizing that technology must adapt to people, not the other way around.

“We want people to interact with digital assets without even realizing they’re using crypto,” he added.

Asadian isn’t just building a company. He’s crafting a more inclusive financial future – one where complex technologies become tools anyone can use.

Listen to the whole interview on The Crypto Radio's live player or in Crypto Curious podcast: Part one and Part two.