Blockchain vs. AI – why academia is moving on

As AI delivers real-world results, blockchain’s adoption hurdles are pushing researchers in a new direction

For years, blockchain was the darling of academia – a revolutionary force set to transform finance, governance, and beyond. Researchers poured time and resources into its potential. But now, many of those same scholars are looking elsewhere. Their new obsession? Artificial intelligence. What changed?

Part of the shift comes down to blockchain’s own growing pains. While the technology has made strides, challenges like scalability, governance, and cost have tempered initial enthusiasm. At the same time, AI has surged ahead, delivering tangible results in automation, predictive analytics, and even creative fields. This transition is also reflected in the financial sector, where institutions are reevaluating their digital strategies – most notably, the European Central Bank’s push for a digital euro.

For someone like Johannes Sedlmeir, who has spent years studying blockchain’s real-world applications, these trends are not surprising. Sharing his critical insights with The Crypto Radio, his comments offer a nuanced perspective on why researchers are pivoting to AI, the governance hurdles blocking blockchain’s enterprise adoption, and whether the digital euro is truly the financial evolution it promises to be.

The academic shift from blockchain to AI

This shift in academic focus isn’t just speculation – it’s backed by data. According to Sedlmeir, concerns about scalability, governance, and implementation costs have long existed.

“We highlighted problems – scalability, data protection, implementation complexity, and costs – quite early,” Sedlmeir told The Crypto Radio. “Now, some academics are being more explicit about these issues or are even moving on from blockchain to other fields like AI.”

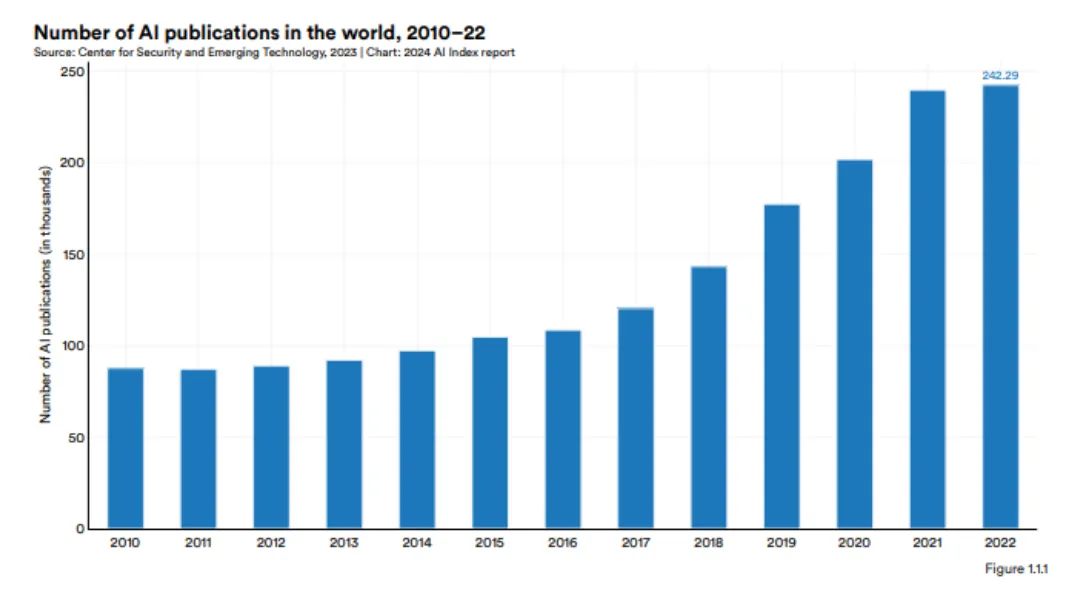

The Artificial Intelligence Index Report 2024, published by Stanford, revealed an exponential rise in AI research, growing from just 88,000 academic publications in 2010 to more than 240,000 in 2022.

Chart from AIIndex Stanford

The numbers reflect a broader industry trend: while blockchain remains in development, AI has taken the lead, capturing global attention with its breakthroughs in automation, predictive modeling, and generative capabilities. Unlike blockchain, which still faces entreprise adoption hurdles, AI is proving its value in real-world applications.

However, Sedlmeir warns that AI may soon face similar roadblocks. The challenges of generative AI – such as reliability issues, hallucinations, and gaps in mathematical and scientific understanding – are likely to become evident as enterprises attempt real-world adoption. Much like blockchain’s early hype, AI’s rapid rise does not guarantee seamless integration into business operations.

That’s not to say blockchain is obsolete – far from it. Instead, the academic world is recalibrating its expectations, focusing less on blockchain as a catch-all solution and more on refining its real-world applications, including tokenized assets.

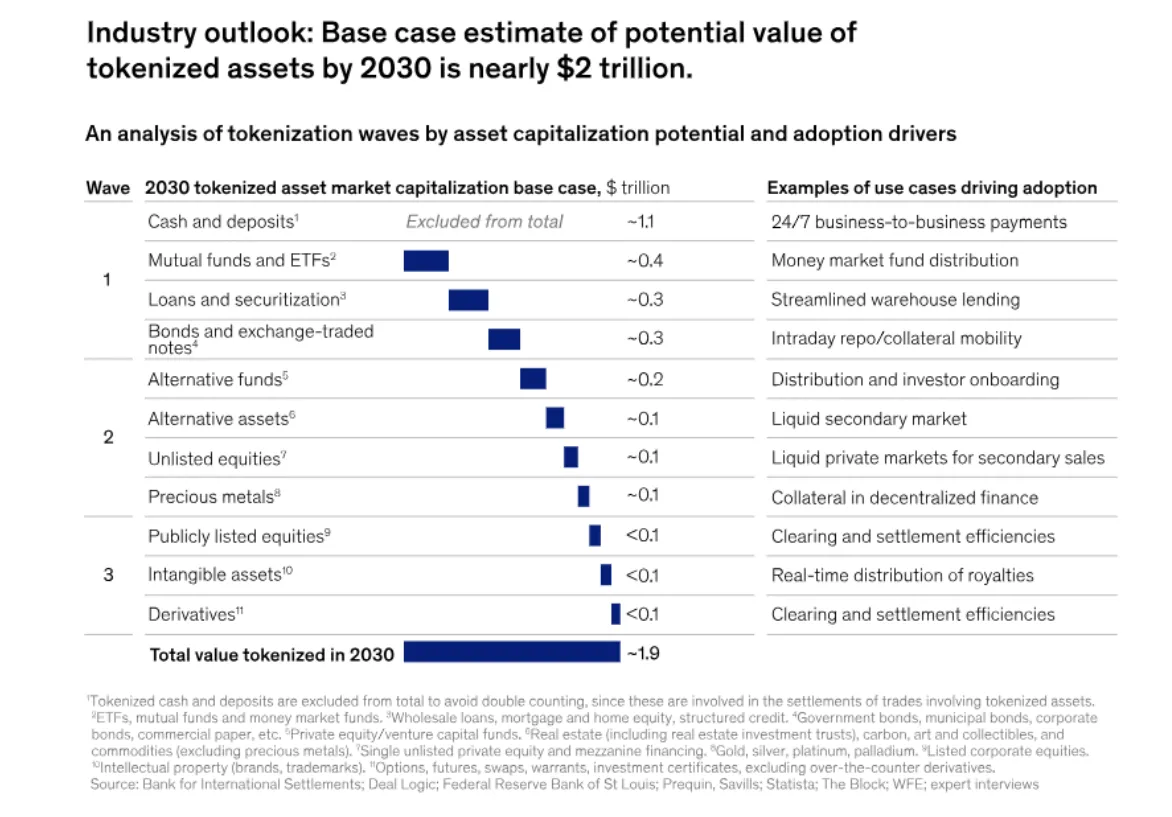

Based on financial giant McKinsey’s estimates, tokenized assets could grow into a nearly $2 trillion industry by 2030.

Chart from McKinsey

Challenges in enterprise blockchain adoption

Blockchain’s potential for enterprises has always been clear: greater transparency, security, and efficiency. However, governance remains a persistent challenge, particularly when integrating blockchain into institutional settings.

“The root of all problems – but also the benefits – of blockchain is the replicated information processing,” Sedlmeir explained. “Stakeholders are expected to run their own nodes and see data that others process on the blockchain.”

This raises critical governance questions: Who funds implementation and integration? When is data visibility beneficial versus problematic? And how do enterprises with varying levels of digital maturity adapt to blockchain-based solutions?

“Blockchain integration only works when a certain level of digitalization has already been achieved, which is often not the case for small and medium-sized organizations,” Sedlmeir added. This technological gap presents a roadblock, limiting blockchain’s reach in sectors where digital infrastructure is still developing.

As a researcher at SnT (Interdisciplinary Centre for Security, Reliability, and Trust), an interdisciplinary research center at the University of Luxembourg, Sedlmeir works at the intersection of theory and application. He believes that collaboration between academia and industry is key to overcoming blockchain’s biggest challenges.

“Many challenges – but also solution approaches – only become apparent through close exchanges between practitioners and researchers,” he said. “Validating solutions can only happen when they are implemented in a pilot or production stage, which academia alone cannot do.”

This necessity for real-world validation underscores the importance of partnerships between research institutions and enterprises. It’s not enough for blockchain solutions to work in theory; they must withstand the complexities of implementation.

Enter the digital euro

One of the most anticipated developments in Europe’s financial sector is the potential introduction of a digital euro. But Sedlmeir remains cautious about blockchain’s role in its creation.

“I do not see a high probability that a digital euro will be blockchain-based,” he said.

However, that doesn’t mean he dismisses the digital euro altogether. “It could be a very good thing,” he says, pointing to its potential to enhance digital sovereignty by reducing Europe’s reliance on non-EU tech giants. Additionally, it could harmonize payments across the EU, lower transaction fees, and provide better privacy compared to current electronic payment systems.

Yet, Sedlmeir warns that current discussions around its implementation still present significant technical and economic shortcomings. If these challenges aren’t addressed, the digital euro risks being more of a bureaucratic experiment than a true financial revolution.

As blockchain research evolves, so do the ambitions of those studying it. While blockchain’s limitations have led some academics to explore AI, others remain focused on refining its governance and enterprise applications. Meanwhile, AI itself may soon encounter its own roadblocks, as enterprises grapple with its reliability and limitations.

Meanwhile, the digital euro represents both an opportunity and a challenge – one that requires careful execution to achieve its intended benefits.

Blockchain’s future isn’t about disruption for disruption’s sake – it’s about solving real problems with smart, practical applications. The real test lies in navigating regulatory hurdles, securing industry adoption, and proving long-term value beyond the hype.