CoinDCX not selling, NBA NFTs hit vending machines

Also: Markets await major U.S. decisions, Turkey’s crypto scene faces backlash, and PayPal expands access to 100+ digital assets

Today's headlines:

Bitcoin steady before Fed, policy update

Japan brings NBA NFTs to vending machines

Coinbase–CoinDCX rumors denied

Crypto CEO jailed in Turkey

India uses AI to crack down on crypto tax cheats

PayPal’s crypto payments launch in the U.S.

Bitwise says Bitcoin’s four-year cycle is breaking

Pump.fun loses momentum as LetsBonk takes over

SuperRare hacked via Tornado Cash exploit

Stablecoins hit $270B as global interest grows

XRP theft tied to country legend’s widow

The Crypto Radio LIVE has just launched across platforms, bringing you the hottest topics of the day wherever you are. Tune in weekdays at 1pm GST – Dubai time – for daily news in a brand new format.

Below is a breakdown of everything we covered today – Tuesday July 29, 2025 – from Japan to Tennessee and vending machines to Bitcoin cycles. Make sure you tune in again tomorrow on YouTube and X to catch the news as it happens.

Bitcoin steady before Fed, policy update

Bitcoin is holding around $118,500 and Ethereum around $3,800, as crypto markets turn cautious ahead of two major events. The Federal Reserve will announce its latest interest rate decision on Wednesday, alongside fresh U.S. GDP data. At the same time, the White House is set to release its first full crypto policy report on July 30, which is expected to include details on the Strategic Bitcoin Reserve and new industry guidelines.

With global crypto market cap down 2.3% to $3.87 trillion and the Fear & Greed Index still firmly in “Greed” territory at 75, traders are watching closely. A hawkish Fed or vague regulation could trigger a pullback, while clarity might open the door to a relief rally.

Japan brings NBA NFTs to vending machines

Web3 meets real-world convenience in Japan, where smart vending machines now sell NBA Top Shot NFTs. The initiative is a collaboration between Dapper Labs and local firm 24karat. Users can buy mystery NFT packs for around ¥1,000 (about $6.70) using mobile payment apps – no wallet setup or crypto required.

Each purchase automatically creates a wallet on Flow blockchain, helping onboard new users with zero friction. Located in train stations and shopping centers, the machines turn NFT collecting into something as easy as grabbing a soda. For NFT adoption, it’s a novel move that lowers barriers and makes collecting social again.

This is innovative and awesome. @NBATopShot collectibles are now available via Japanese vending machines. 🇯🇵 https://t.co/xitErMlUnD pic.twitter.com/t032zASyq5

— Steve 🏀 (@intangible_eth) July 28, 2025

Coinbase–CoinDCX rumors denied

India-based exchange CoinDCX has firmly denied reports that it’s in acquisition talks with Coinbase, following media speculation triggered by CoinDCX’s valuation dip after a recent $44 million hack. CEO Sumit Gupta posted, “Ignore the rumors. We are super focused on building for India.”

Just got up and saw this news! 😅

– Sumit Gupta (CoinDCX) (@smtgpt) July 29, 2025

Ignore the rumours! CoinDCX is “super focused” on building for India’s crypto story and not up for sale!

Will share more later but just wanted to clarify this upfront! https://t.co/4CqAf94GjT

The denial comes as Coinbase renews its interest in India, having recently secured a Financial Intelligence Unit license. While the U.S. giant is reportedly eyeing expansion in the region, CoinDCX appears determined to grow independently, maintaining $14 million in daily volume and around $160 million in assets.

Crypto CEO jailed in Turkey

Turkish crypto exchange ICRYPEX’s expansion plans face uncertainty after founder’s arrest. Photo: Unsplash / Michael Jerrard

The founder of ICRYPEX, a crypto exchange based in Istanbul, has been jailed on unrelated charges following reports he provided financial support to a jailed journalist known for criticizing the Turkish government. While the charges are officially tied to other alleged offenses, the timing has raised eyebrows in Turkey’s crypto and media circles.

ICRYPEX had been aggressively expanding internationally, opening offices in Dubai, London, and Toronto, and announcing plans to grow across Latin America and South Africa. The arrest throws uncertainty over those plans and highlights the political risks that crypto executives can face in tightly controlled jurisdictions.

India uses AI to crack down on crypto tax cheats

India’s Income Tax Department has turned to artificial intelligence and data-matching tools to track crypto-related tax evasion. In a recent update to Parliament, officials revealed the AI-driven initiative helped recover ₹437 crore – roughly $52 million – in taxes linked to virtual digital assets for the 2022–23 fiscal year.

The system compares transaction data submitted by crypto exchanges with user filings, flagging mismatches for investigation. Officials say the broader goal is to integrate crypto assets into global tax reporting frameworks through India’s new Crypto-Asset Reporting Framework (CARF). It’s part of a trend toward real-time, automated enforcement.

PayPal’s crypto payments launch in the U.S.

PayPal has launched a new payment feature that allows U.S. merchants to accept over 100 cryptocurrencies, including Bitcoin and Ethereum, via major wallets like MetaMask, Coinbase, and Binance. The feature – called “Pay with Crypto” – converts payments to U.S. dollars through PayPal’s PYUSD stablecoin.

Initially, transaction fees are set at 0.99%, but will rise to 1.5% after one year. Merchants who hold funds in PYUSD can earn up to 4% APY. The rollout begins “in the coming weeks,” with expansion plans already in motion – though New York is not yet approved. If widely adopted, this could be one of the biggest real-world uses of crypto payments to date.

Is Bitcoin’s four-year cycle breaking?

Is Bitcoin’s famous four-year cycle finally over? That’s what Bitwise CIO Matt Hougan argues. Traditionally, Bitcoin’s price has moved in boom-and-bust patterns tied to its halving events every four years. But Hougan believes new forces – like rising institutional interest, smoother regulation, and Bitcoin ETFs – are now shaping price action more than mining supply.

Why is the four-year cycle dead?

– Matt Hougan (@Matt_Hougan) July 25, 2025

1) The forces that have created prior four-year cycles are weaker:

i) The halving is half as important every four years;

ii) The interest rate cycle is positive for crypto, not negative (as it was in 2018 and 2022);

iii) Blow-up risk is… https://t.co/F9ybjHEeB5

He says these trends operate on longer timeframes, with less predictable spikes but more sustained growth. If true, that could make the 2026–2030 period more stable and fundamentally driven, shifting how traders and institutions time their moves.

Pump.fun loses momentum as LetsBonk takes over

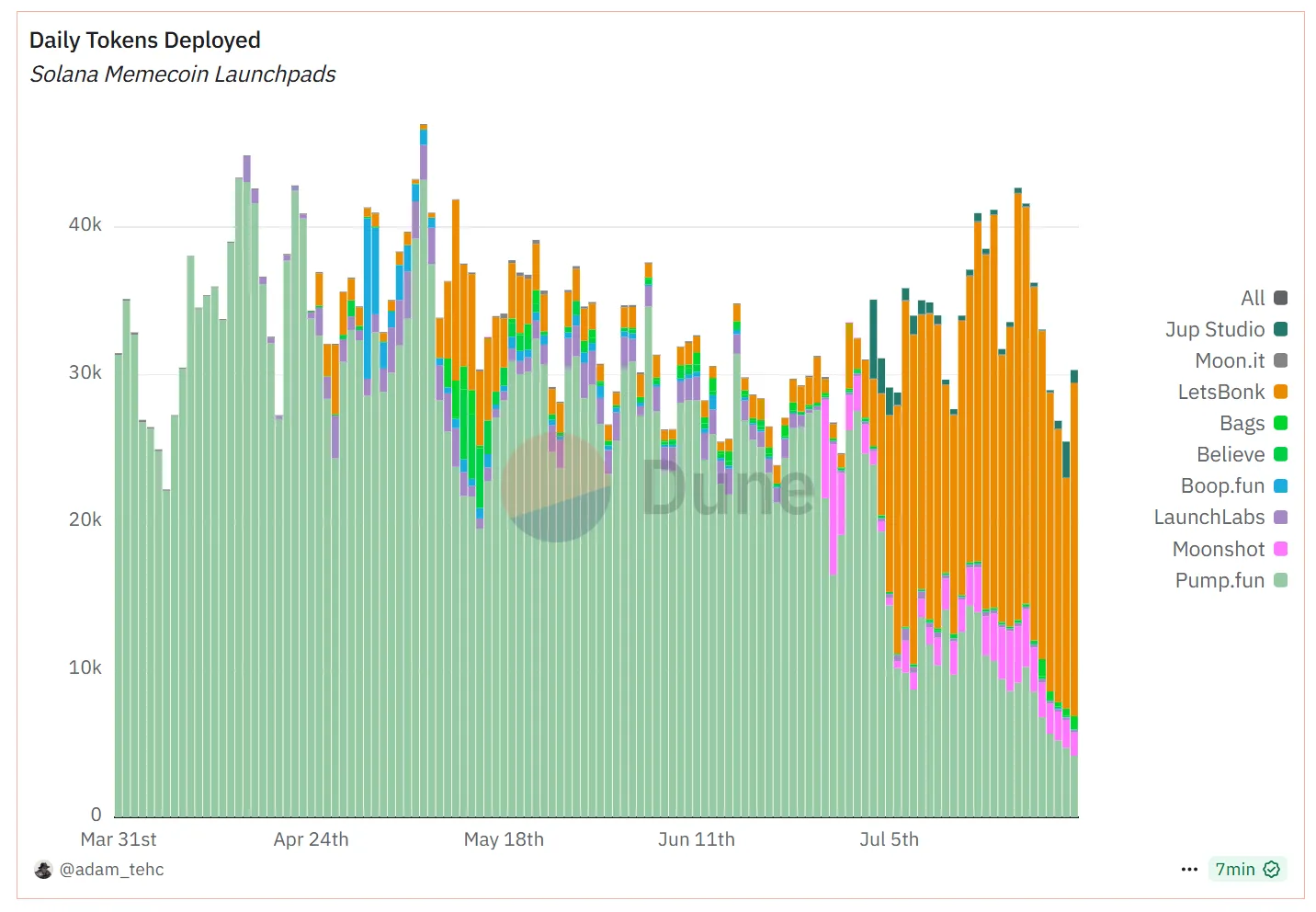

Once the dominant launchpad for Solana-based memecoins, Pump.fun has seen its token deployment share fall from 88% to just 19% in the past month. Daily revenue has plummeted from over $1 million to under $200,000, and its native token PUMP has dropped 60% in less than two weeks.

Meanwhile, a newer platform, LetsBonk, is gaining traction – now driving nearly 70% of new memecoin launches on Solana. With viral tokens like DEBT hitting $14.8 million in market cap, traders are clearly flocking to fresher, more engaging ecosystems. It’s a sharp reminder that in the memecoin world, hype fades fast unless platforms evolve.

July has seen a turning point in customer behavior, with LetsBonk overtaking Pump.fun in token launches. Photo: Dune / @adam_tehc

SuperRare hacked via Tornado Cash exploit

NFT platform SuperRare suffered a $731,000 loss in RARE tokens after a hacker exploited a flaw in its staking contract. Blockchain sleuths linked the attacker’s wallet to Tornado Cash, a crypto mixer previously used by the same entity 186 days ago. According to security firm SlowMist, the vulnerability involved a permission-check failure in the updateMerkleRoot function.

The stolen tokens have yet to be moved, but the hack could undermine trust in NFT staking at a time when confidence is already shaky. SuperRare, known for its high-end digital art and physical galleries in New York, has not yet commented on the breach.

Stablecoins hit $270B as global interest grows

Stablecoins are heating up fast, with the global market cap crossing $270 billion – a record high. Google searches for “stablecoins” are also at an all-time peak. The surge follows U.S. momentum from the GENIUS Act, which laid the groundwork for regulatory clarity, prompting institutions like Interactive Brokers to consider launching their own coins.

Globally, China is advancing yuan-backed stablecoins through Hong Kong, while South Korea’s lawmakers are debating how tightly to regulate won-pegged tokens. This multi-front push signals that stablecoins are no longer just a crypto sideshow – they’re becoming a major force in both fintech and geopolitics.

XRP theft tied to country legend’s widow

A man in Tennessee has been arrested for allegedly stealing more than 5 million XRP tokens – worth $17 million at current prices – and $400,000 in cash from Nancy Jones, widow of country music icon George Jones. The accused, Kirk West, reportedly had a past romantic relationship with Nancy and convinced her to buy crypto in 2016.

Authorities say West broke into her safes and attempted to flee the state, but was apprehended at Nashville airport. The case has sparked headlines not only for the sum involved, but also as a cautionary tale of how personal relationships can be exploited for digital asset theft.