Kevin Soltani: 'Medical tech on the blockchain is my north star'

'Why aren’t patient records on chain?' he asks, as millions still move data through disconnected hospital systems

“Why aren’t patient records on chain? Why are labs not speaking to each other?"

We track our sleep, our heart rate, our movement, and our DNA through apps and subscriptions, yet our most important records still live inside closed hospital systems and disconnected databases. Health data moves slowly, access remains fragmented, and patients rarely control their own information.

"Medical should be the purest industry, and it’s ironically the dirtiest,” Kevin Soltani, founder and CEO of Gima Group, told The Crypto Radio. He sees blockchain’s most urgent role is in rebuilding broken systems – starting with healthcare.

Soltani has spent more than a decade inside crypto’s early infrastructure, mining era, and growth-stage companies. His perspective is shaped less by hype and more by scars earned through cycles that have wiped out projects, fortunes, and false promises alike.

What a decade in crypto teaches you

“I started in Bitcoin mining and research in 2012 but I don’t currently mine anymore. We stopped Bitcoin mining, and then we started, actually altcoin mining.”

Soltani entered the crypto space early, unsure of what would come next. “We knew something was happening. We knew something was gonna happen. We just didn’t know what.”

His view of the industry hardened through years of volatility, scams, and collapse.

“You don’t have to be right 10 times out of 10 in crypto, you just had to have done one thing, it’s called HODLing.”

That patience informs how he now operates. Through Gima Group, Soltani invests in and works directly with growth-stage blockchain companies – the most fragile and stressful phase of a startup’s life.

“We love growth, that’s the most stressful part of the life cycle. That’s what we do. I’m in the trenches.”

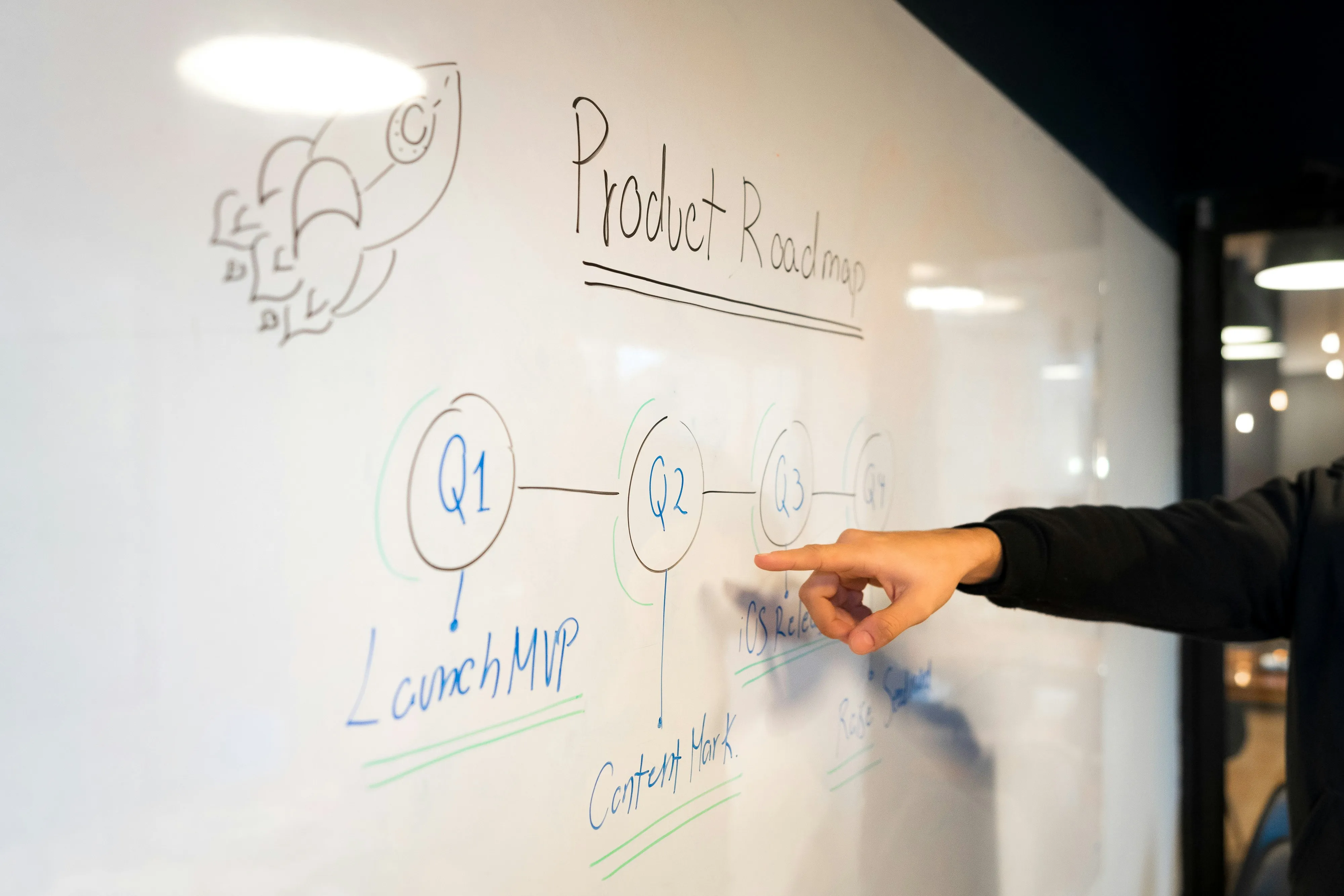

A new generation of blockchain startups is building infrastructure that treats digital ownership as part of everyday business operations. Photo: Unsplash / Slidebean

Where blockchain companies really struggle

For Soltani, blockchain’s real thesis is ownership. He believes it will reshape industries where users currently have little control – especially healthcare and gaming.

He is openly skeptical of consumer wellness technology that monetizes personal data. “I’m not interested to give my data to someone who owns everything," he said. "Being on chain can make me feel a little happier, just the data side alone.”

Blockchain, he argues, introduces the possibility that individuals could finally own, move, and even monetize their medical records rather than surrender them to platforms and insurers.

Gaming presents a parallel future. Digital items feel real to players, but remain trapped inside closed ecosystems.

“Ownership, ownership, ownership. If I could own that sword… If I could keep it after 20 years… Right now, it would be worth more than a Michael Jackson signature or a Kobe Bryant signature.”

He sees blockchain-based gaming as the foundation of persistent digital economies that could eventually span platforms and generations.

How ownership becomes portable

For Soltani, tokenization is the layer that allows records and rights to move between systems instead of remaining locked inside institutions.

“You could tokenize stocks, bonds. It doesn’t need to have crypto – that is a false narrative.”

He argues that blockchain can function as infrastructure for registries, records, and financial systems without relying on public tokens or trading markets. In that model, tokenization becomes a way to represent real-world claims, data, and assets as portable digital objects that can travel across platforms and borders.

Healthcare sits at the center of that shift. Medical histories, diagnostics, and patient records are examples of information that could move between providers while preserving integrity and ownership.

“So as a finance guy, medical technology on the blockchain is my north star.”

Healthcare remains one of the industries where digital records move slowly and ownership of personal data is still fragmented. Photo: Unsplash / Nappy

The money rail and the next infrastructure layer

If tokenization defines what can be owned, stablecoins define how value moves through that ownership layer.

“Stablecoins are the only answer to solve the biggest problems in this industry. How could you believe that we’re going to stay in a fiat system?”

Soltani views stablecoins as the connective tissue between digital infrastructure and everyday economic activity. While blockchains can host records, assets, and identity, stablecoins provide a programmable way to move money across borders, platforms, and applications without rebuilding the entire banking stack.

He sees momentum accelerating in regions investing directly in digital infrastructure, particularly across Asia and the Middle East, where financial rails, identity systems, and data markets are forming side by side.

“We’re really mixing in cross-industry collaboration – medical technology, AI, blockchain, and gaming.”

For Soltani, the convergence of blockchain and AI points toward new healthcare, compute, and data markets – areas he believes will quietly define the next decade of adoption.

The philosophy behind the builder

Despite the volatility, Soltani remains relentlessly optimistic. “If you don’t like your job, quit. Do what you want, with who you want, when you want, however you want.”

To younger builders, his advice stays simple. “If you got only $100 invest $99 of it in yourself.”

For him, ownership is not just digital. It is personal. Control over data, money, and direction form the same philosophy – one where technology becomes a tool for agency rather than abstraction.

And if his vision proves right, blockchain’s most lasting impact may not be financial at all – but human.