Today in crypto: New York eyes blockchain elections

FBI sting exposes Musk-themed crypto launderer while Argentina investigates officials over failed memecoin

New York explores blockchain for election security

New York State Assemblyman Clyde Vanel has introduced a bill proposing a study on how blockchain technology could secure election systems.

Assembly Bill A7716 would require the state’s Board of Elections to collaborate with cybersecurity and blockchain experts and issue a report within one year. It defines blockchain as a “decentralized, cryptographically secured, immutable and auditable ledger capable of delivering an uncensored truth.”

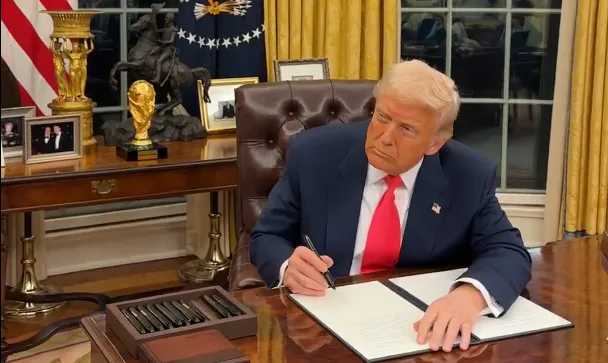

The legislation follows years of failed attempts to pass similar bills in New York but comes amid rising interest nationwide. Utah recently passed a law protecting crypto activity, and 26 U.S. states are currently reviewing Bitcoin reserve proposals in response to Trump’s executive order establishing a Strategic Bitcoin Reserve.

FBI ran undercover crypto sting using Musk alias

The FBI secretly operated a crypto laundering business under the alias “elonmuskwhm” as part of a year-long sting targeting darknet criminals.

According to court documents reported by 404 Media, federal agents took over the operation after arresting its founder, Anurag Pramod Murarka, who laundered more than $20 million for drug traffickers and hackers, including members of the Scattered Spider group.

Murarka was sentenced in January to 10 years in prison. The FBI used his accounts and methods to intercept an additional $1.4 million, running the operation out of a post office in Kentucky.

The scheme included hiding cash in envelopes and children’s books and converting crypto through illegal hawala networks. The sting ended with Murarka’s arrest upon entering the U.S. on a lured visa approval.

Argentina opens inquiry into LIBRA token crash

Argentina’s Chamber of Deputies has voted to launch a full investigation into the Solana-based LIBRA token scandal that rocked President Javier Milei’s administration earlier this year.

The special commission will summon several top officials, including the Economy Minister, Justice Minister, Chief of Staff, and the head of the national securities watchdog, as it probes possible misconduct tied to the president’s promotion of the token.

Milei promoted LIBRA in February, touting it as a private initiative to boost the Argentine economy. The token briefly reached a $4.5 billion market cap before crashing 90% within hours. The president later deleted his promotional post, claiming he “did not know the details” of the project.

Roughly 75,000 investors were affected, with estimated losses of $250 million. A parallel judicial probe is also ongoing.

Bitcoin drops as Trump tariffs take hold

Bitcoin and Ethereum prices dropped sharply on Wednesday after President Donald Trump's new tariffs on Chinese goods kicked in at midnight.

Bitcoin fell 4.1% to $76,550, briefly dipping below $75,000 late Tuesday – a 30% drop from its January high of over $109,000. Ethereum saw an even steeper decline, falling 8.3% to hit its lowest level since March 2023. Other cryptocurrencies were also hit hard, with Dogecoin down 16.3%, Solana down 18%, and Cardano down nearly 24% over the past week, according to CoinGecko.

The selloff wiped around $411 million in leveraged positions over 24 hours and has now erased over $1.2 trillion from crypto markets since early February, according to CoinGlass.

Traditional markets mirrored the crypto crash. Japan’s Nikkei 225 fell 2.6% by midday, while Australia's ASX 200 lost 2%. In the U.S., the S&P 500 dropped another 1.5% on Tuesday, bringing its decline since mid-February to nearly 20% – approaching official bear market territory.

Bond market stress also intensified. The 10-year Treasury yield jumped between 4.2% and 4.4% – one of the steepest intraday surges since WWII – and a Treasury auction for three-year notes saw the weakest demand since late 2023, raising concerns over foreign appetite for U.S. debt.

Octane raises $6.7M for AI code security

As security remains a major weak spot for crypto developers, San Francisco-based Octane is tackling the issue head-on with a new AI-powered code auditing platform – and $6.7 million in fresh backing.

Founded in 2023 by Giovanni Vignone, Octane integrates directly into GitHub and automatically scans smart contracts for vulnerabilities while developers are still writing them. It summarizes pull requests, flags risky patterns, and helps teams fix bugs before they go live.

The round was led by Winklevoss Capital and Archetype, with support from Circle, Gemini, Druid Ventures, and others. Gemini co-founder Tyler Winklevoss called it a vital step toward making crypto more secure.

Despite security budgets often ranging from $50,000 to $200,000 per year, the industry still lost $2.2 billion to exploits in 2024. Four months into 2025, that number has nearly been matched.

Octane currently focuses on Solidity and Ethereum-compatible chains but plans to expand to Solana and beyond.

‘Hawk Tuah Girl’ returns with new podcast

Hailey Welch – better known as “Hawk Tuah Girl” – has returned to podcasting following her high-profile memecoin fiasco.

Welch’s Solana-based $HAWK token exploded to a $490 million market cap in December before collapsing 93% within minutes. Welch subsequently distanced herself from the project, saying she would no longer support it, and went silent online.

She returned this week with a new episode of her Talk Tuah podcast, joined by YouTuber KSI. While they didn’t directly mention crypto, both discussed the dark side of online fame. “In this influencer industry, people are going to use and abuse you,” KSI said. Welch replied: “I found that out the hard way.”

Welch remains a cooperating witness in a civil lawsuit targeting the token’s creators. The SEC has closed its investigation into her personal involvement.